Wheeling involves the use of transmission lines, transformers, and other equipment to transfer power between utility systems, power pools, or other entities. Wheeling, balancing, and congestion are essential terms that refer to different aspects of power system design. They play a crucial role in maintaining the grid’s stability and ensuring efficient power transfer from one point to another.

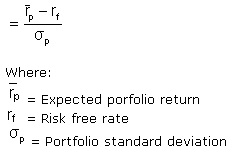

The equity equation

- Therefore, the price of its luxury tea products is usually higher than the price of tea products from other tea companies operating in the same industry.

- To find the net change, you subtract the previous period’s value ($7,000) from the current value ($5,000) to arrive at a net change of $2,000.

- Its monopoly power allows it to charge higher prices for its luxury tea products, making it difficult for new entrants to enter the luxury tea industry.

- To recap, you’ll find the assets (what’s owned) on the left of the balance sheet, liabilities (what’s owed) and equity (the owners’ share) on the right, and the two sides remain balanced by adjusting the value of equity.

- Owner contributions and income result in an increase in capital, whereas withdrawals and expenses cause capital to decrease.

The annual rate of earnings per share (EPS) growth over the period from 2006 to 2016 can be calculated using the compound annual growth rate (CAGR) formula. Investors or managers can use ROA to assess the general health of the company to see how efficiently it’s being run and how competitive it is. Investors often use ROA in deciding whether to put money into a company and evaluate its potential for returns relative to others in the same industry. Basel III established a minimum 3% leverage ratio requirement for banks, but the higher the Tier 1 leverage ratio, the stronger a bank’s financial standing. A leverage ratio’s denominator will change based on the ratio you pick for your business.

Everything You Need To Master Financial Modeling

A balance sheet explains the financial position of a company at a specific point in time. As opposed to an income statement which reports financial information over a period of time, a balance sheet is used to determine the health of a company on a specific day. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company.

What Is Shareholders’ Equity in the Accounting Equation?

Some examples of short-term liability include credit card debt, insurance premiums payable, payroll taxes, or staff wages. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. With liabilities, this is obvious – you owe loans to a bank, or repayment of bonds to holders of debt, etc. These are also listed on the top because, in case of bankruptcy, these are paid back first before any other funds are given out.

The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof. Market swings can also occur while you hold your asset, causing its value to fall. We saw this during the 2008 financial crisis when housing values collapsed. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. The design of Wheeling, on the other hand, is concerned with transmission planning and management. It refers to the process of transmitting power from one point to another through the grid’s transmission system.

- While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

- A leverage ratio’s interpretation depends on the ratio you use to judge your company’s financial leverage.

- Drawings are amounts taken out of the business by the business owner.

- Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment.

Investors may be rewarded with higher returns, but it is also more difficult to sell investments in a company that is not publicly traded. The court can appoint an independent investigator to examine the company’s operations, financial records, and conduct interviews with relevant parties to determine if any wrongdoing has occurred. In the long-run equilibrium, assets liabilities equity formula a competitive firm achieves maximum efficiency by operating at the minimum average cost and earning only normal profits. It faces perfect competition, resulting in price equaling marginal cost. On the other hand, a monopolistically competitive firm operates at a higher average cost due to product differentiation, leading to excess capacity.

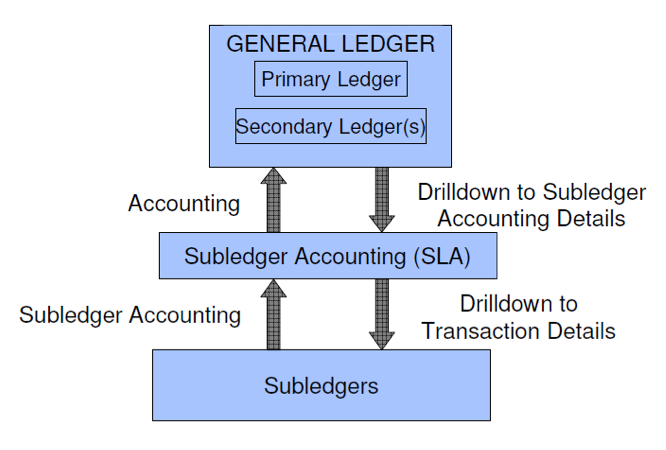

Accounting Equation

Here we can see the list of all assets that have been reported on Hershey company balance sheet for 2023. Without understanding assets, liabilities, and equity, you won’t be able to master your business finances. But armed with this essential info, you’ll be able to make big purchases confidently, and know exactly where your business stands. Accountants call this the accounting equation (also the “accounting formula,” or the “balance sheet equation”). Because the value of liabilities is constant, all changes to assets must be reflected with a change in equity. This is also why all revenue and expense accounts are equity accounts, because they represent changes to the value of assets.

The accounting equation is a core principle in the double-entry bookkeeping system, wherein each transaction must affect at a bare minimum two of the three accounts, i.e. a debit and credit entry. Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. Last, a balance sheet is subject to several areas of professional judgement that may materially impact the report. For example, accounts receivable must be continually assessed for impairment and adjusted to reflect potential uncollectible accounts.